Table of Content

- Typical home price in Virginia: $379,206 (88% of typical U.S. price)

- Typical home price in Wisconsin: $266,750 (62% of typical U.S. price)

- Typical home price in Arkansas: $177,710 (41% of typical U.S. price)

- Typical home price in Connecticut: $383,222 (89% of typical U.S. price)

- Costs & Homeownership by State

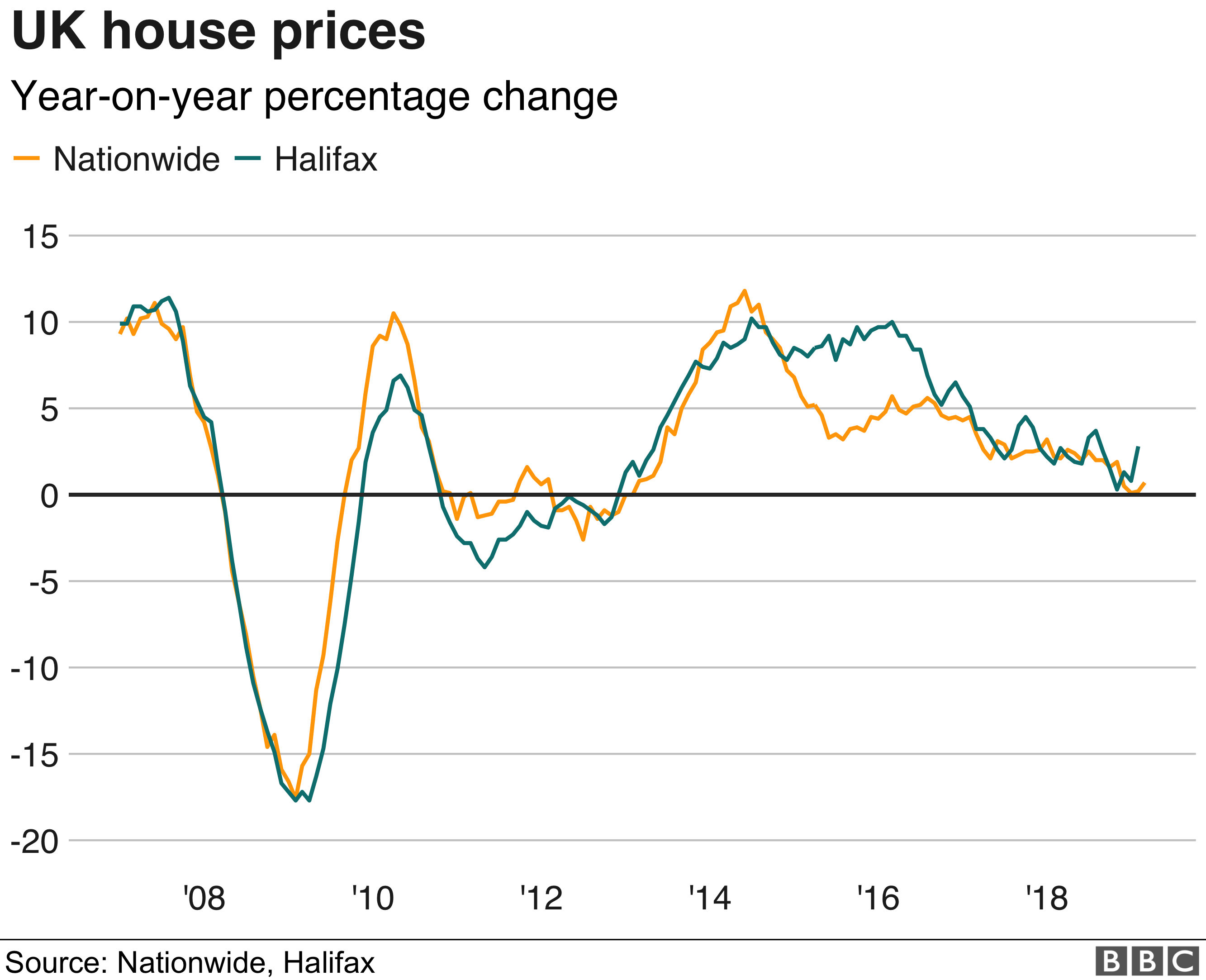

- Statistics on Residential property market in London (UK)

- States with the Lowest Median Home Price

That makes them more well-off than the general population, since $72,000 is roughly the median income for a middle-class family of three. Wyoming has less-expensive homes than the norm, and earnings are only 4% lower than the median income. It still doesn't manage to pass the 28% rule, even though it's fairly close. Homeowners in Missouri don't need to spend too much of their money on their mortgages. Housing costs are well below the typical U.S. price, and earnings are only 8% less than the national median. Mortgage rates fell significantly in 2020, driving up demand as homebuyers looked to take advantage.

The bank or mortgage lender will only let you borrow X amount based on your income, assets, and down payment. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Putting 20% down means you don't need to pay private mortgage insurance. The typical homeowner in Louisiana spends just over a quarter of their salary on their mortgage. That reasonable amount is due to the cheap housing, as incomes in this state are 25% lower than the U.S. median.

Typical home price in Virginia: $379,206 (88% of typical U.S. price)

While Alabama has a low median income (19% below the national median), its typical house prices are even lower. Because of that, residents don't pay too much for their mortgages. The current selling rate for houses in the state of Kentucky averages $168,000 or $117 per square foot. Property taxes are well below the national average at .83%, and the cost of living index is around 93 to 94, but the median household income is a bit low at $50,000. Last year was an eventful one for homebuyers looking to get into the market. Home prices soared and bidding wars were rampant in many housing markets, though mortgage rates remained relatively low.

The median home value of all houses in South Carolina is $165,800. The median worker in South Carolina pulls in $40,486 in annual earnings. The median home value of all houses in Rhode Island is $282,600. The median worker in Rhode Island pulls in $51,286 in annual earnings.

Typical home price in Wisconsin: $266,750 (62% of typical U.S. price)

The thing is – statistics tell us that very few homeowners stay in one place for long. The expected tenure for many folks is a decade or less, for a variety of reasons. It’s just what they’ve determined you qualify for based on your credit history, employment, and perhaps an estimate of your income. Even if you want to buy a $1 million house, you might be limited to a $400,000 property thanks to your finances. Lyle is a writer specializing in credit cards, travel rewards programs, and banking.

That’s far below the 5- to 6-month supply that we’d see in a balanced market. There simply aren’t enough homes on the market to cater to prospective buyers. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved.

Typical home price in Arkansas: $177,710 (41% of typical U.S. price)

Homeownership in the state is slightly higher than the national average, with 66.5% of residents owning their homes. The Ascent also has a mortgage calculator that can help you figure out mortgage payments and house affordability calculator to help you determine how much real estate you can afford. Despite below average housing costs in North Carolina, median income 11% less than the national average leads residents in the state to miss the 28% rule. New Jersey is home to high housing costs and high salaries (31% more than the national median).

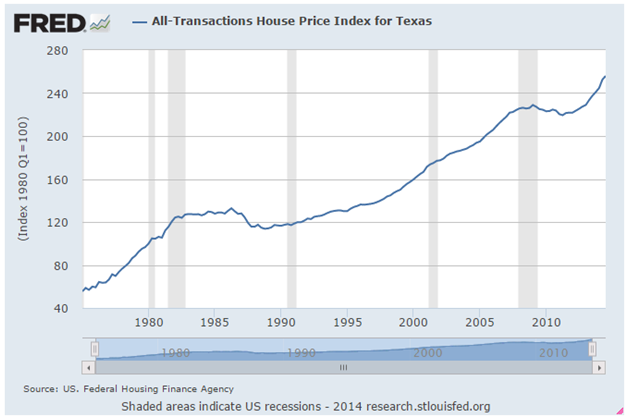

The Zillow Home Value Index isn't an average, but it represents the typical home value in a given area. Home prices tend to rise over time with the occasional outlier. In recent history, that outlier was the Great Recession, which caused both median and mean home prices to drop. The median home price in the United States is $428,700 as of the first quarter of 2022.

According to the latest census data, 65.4% of U.S. households own their home. The District of Columbia has the lowest rate of homeownership, at 40.3%. California, New York, and Hawaii are among the states with the highest housing prices and the lowest levels of homeownership.

You may also want to try to find a home with minimal maintenance needs. Be sure to work with a reputable real estate agent in either case. Incomes have not increased on pace with those rising prices, making home ownership even more challenging for many millennials. Being financially ready and teaming with a Realtor will greatly impact your home-buying experience. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

Peggy James is an expert in accounting, corporate finance, and personal finance. She is a certified public accountant who owns her own accounting firm, where she serves small businesses, nonprofits, solopreneurs, freelancers, and individuals. Nineteen states now have an average gas price of under $3 a gallon, including Minnesota, Ohio and Colorado. Ask your Realtor to recommend lenders to help you get prequalified for a loan amount. When you find your dream house, determine your bidding strategy with your Realtor to help you get through the bidding process smoothly while watching out for your best interest. With a signed contract, your Realtor will guide you through the closing steps as swiftly as possible.

And although future changes to the cash rate are unknown, assuming just a 1% increase in the average discounted variable interest rate by 2026 will see homebuyers worse off. Waiting five years could set buyers back $548 in their monthly repayments, or a total of $211,616 over a 30-year mortgage period. Data from the 2019 American Community Survey shows that homeowners paid a median amount of $1,609 per month.

No comments:

Post a Comment